During

regular trading

hours,

there

were many

stocks

that continued

to break

up to

the

upside.

These

stocks are

usually

going up

with

news.If

you are

looking

to day

trade

today,

you

might want

to

check out

the

following

stocks. I

usually

throw

these

on my

watch

list and

monitor with

resistance

& support

levels. My Daily Trading Activities & Stocks to Buy Everyday - Membership Access

Top Stocks Performance of the day:My Daily Trading Activities & Stocks to Buy Everyday - Membership Access

Biggest Gainers 11/30/12

Composite Biggest Gainers

FIVE Five Below, Inc. 18.35%

HALO Halozyme Therapeutics, Inc. 9.11%

LQDT Liquidity Services, Inc. 8.54%

CISG Cninsure Inc. 8.37%

QLTY Quality Distribution Inc. 8.25%

SGYP Synergy Pharmaceuticals, Inc. 8.01%

ENZN Enzon Pharmaceuticals Inc. 7.88%

ULTA Ulta Salon, Cosmetics & Fragrance, Inc. 7.65%

CLSN Celsion Corp. 7.30%

MPO Midstates Petroleum Company, Inc. 7.01%

ACTV The Active Network, Inc. 6.14%

WLT Walter Energy, Inc. 5.78%

KEG Key Energy Services Inc. 5.35%

THRX Theravance Inc. 5.05%

PCS MetroPCS Communications, Inc. 5.03%

ELGX Endologix Inc. 4.94%

BLOX Infoblox Inc. 4.93%

MACK Merrimack Pharmaceuticals, Inc. 4.85%

IMPV Imperva Inc. 4.77%

PFPT Proofpoint, Inc. 4.76%

ALXA Alexza Pharmaceuticals Inc. 4.76%

GNMK GenMark Diagnostics, Inc. 4.76%

Z Zillow, Inc. 4.72%

HMST HomeStreet, Inc. 4.63%

RES RPC Inc. 4.52%

NSM Nationstar Mortgage Holdings Inc. 4.19%

ANR Alpha Natural Resources, Inc. 4.18%

LEAP Leap Wireless International Inc. 4.17%

GVA Granite Construction Incorporated 4.15%

Composite Biggest Losers

Ticker Company Chang

NTLS NTELOS Holdings Corp. -20.22%

SUPN Supernus Pharmaceuticals, Inc. -18.72%

VRSN VeriSign, Inc. -13.19%

MDRX Allscripts Healthcare Solutions, Inc. -10.47%

YUM Yum! Brands, Inc. -9.92%

GCO Genesco Inc. -8.65%

QCOR Questcor Pharmaceuticals, Inc. -8.06%

NXST Nexstar Broadcasting Group Inc. -7.02%

CBE Cooper Industries plc -6.11%

SAAS inContact, Inc. -5.97%

REGN Regeneron Pharmaceuticals, Inc. -5.96%

INSM Insmed Incorporated -5.67%

DDD 3D Systems Corp. -5.17%

OVTI OmniVision Technologies Inc. -5.03%

CLDX Celldex Therapeutics, Inc. -4.96%

GGB Gerdau S.A. -4.82%

TSRO Tesaro, Inc. -4.59%

ABMD Abiomed Inc. -4.23%

MMR McMoRan Exploration Co. -4.16%

BSFT BroadSoft, Inc. -4.06%

GDP Goodrich Petroleum Corp. -4.05%

RGLD Royal Gold, Inc. -3.85%

EDU New Oriental Education & Technology Group -3.82%

MYGN Myriad Genetics Inc. -3.79%

UA Under Armour, Inc. -3.72%

SEM Select Medical Holdings Corporation -3.58%

HOV Hovnanian Enterprises Inc. -3.51%

SGY Stone Energy Corp. -3.49%

CACI CACI International Inc. -3.40%

SP 500

Long term signals : Bullish

Short term signals : Bearish

Stop @ 1300

QQQ (Nasdaq 100) : Bearish, stop @ 50

INDU: Bullish, stop @10000

COMPQ:Bearish, stop @ 2300

Top trend : Techs

Value : Financial

Euro Dollar : Bullish

US Dollar index : Bearish

Gold : Bearish, stop @ 1500

10 Y US Yield : Bullish, above 2.8 stop

30 Y US Bond : Short, stop @ 132

World Market

Germany's DAX: Bullish, stop @ 5300

France's CAC: Bullish, stop @ 2900

Shanghai : Bearish

Japan Nikkei : Bearish

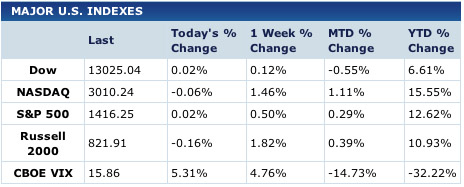

Stocks ended narrowly mixed in lackluster trading on the final day of November, as investors were reluctant to make big bets ahead of the weekend amid ongoing "fiscal cliff" discussions.

Stocks have been choppy in the recent weeks as investors reacted to a chain of mixed remarks from lawmakers in Washington on the progress of the fiscal cliff talks.

The Dow Jones Industrial Average eked out a gain of 3.76 points to close at 13,025.04 in volatile trading. Wal-Mart gained, while Microsoft lagged.

The S&P 500 squeezed out a gain of 0.23 points to end at 1,416.25, while the Nasdaq slipped 1.79 points, to finish at 3,010.24. Both indexes ended in positive territory for the month. The CBOE Volatility Index, widely considered the best gauge of fear in the market, finished near 16.

For the month, the Dow slipped 0.55 percent, while the S&P 500 rose 0.29 percent, and the Nasdaq rallied 1.11 percent. Intel was the worst monthly performer on the Dow, while Cisco soared.

On Tap Next Week:

MONDAY: ISM manufacturing index, construction spending, Fed's Bullard speaks, auto sales; Earnings from PepBoys

TUESDAY: Earnings from AutoZone, Toll Brothers, Pandora, Mattress Firm

WEDNESDAY: Weekly mortgage apps, ADP employment report, productivity & costs, factory orders, ISM non-mfg index, oil inventories; Earnings from Men's Warehouse

THURSDAY: BoE announcement, Challenger job-cut report, ECB announcement, jobless claims, quarterly services survey, Apple/Samsung hearing; Earnings from H&R Block, Lululemon, Smithfield Foods, Cooper Cos.

FRIDAY: Employment situation, consumer sentiment, consumer credit

Support for the SPX remains at 1400 and then 1370 with resistance at 1417 and then 1434 .So we should trade small lot.Take a look all 1/5/15/60m chart if we want to trade this market.

I also have technical analysis different stocks-Right Here.

Take a look some market indicator charts- Click all charts

$SPX - 60 minSPX DAILY CHARTS

QUICK LOOK ALL MAJOR INDEX WEEKLY

$SPX with component chart

$VIX

$CPC daily

QQQQ Daily

COMPQ

FOR 12/3 SPX resistance, pivot & support

Paid Membership Membership Access

FOR Weekly 12/3-12/6 SPX resistance , pivot & support

Paid Membership Membership Access

http://dailymarketanalysis-blog.blogspot.com/